how do you calculate cash flow to creditors

If you owe 10000 to someone you want to know the amount of. Tightening credit to reduce investments made in accounts receivable.

The formula for free.

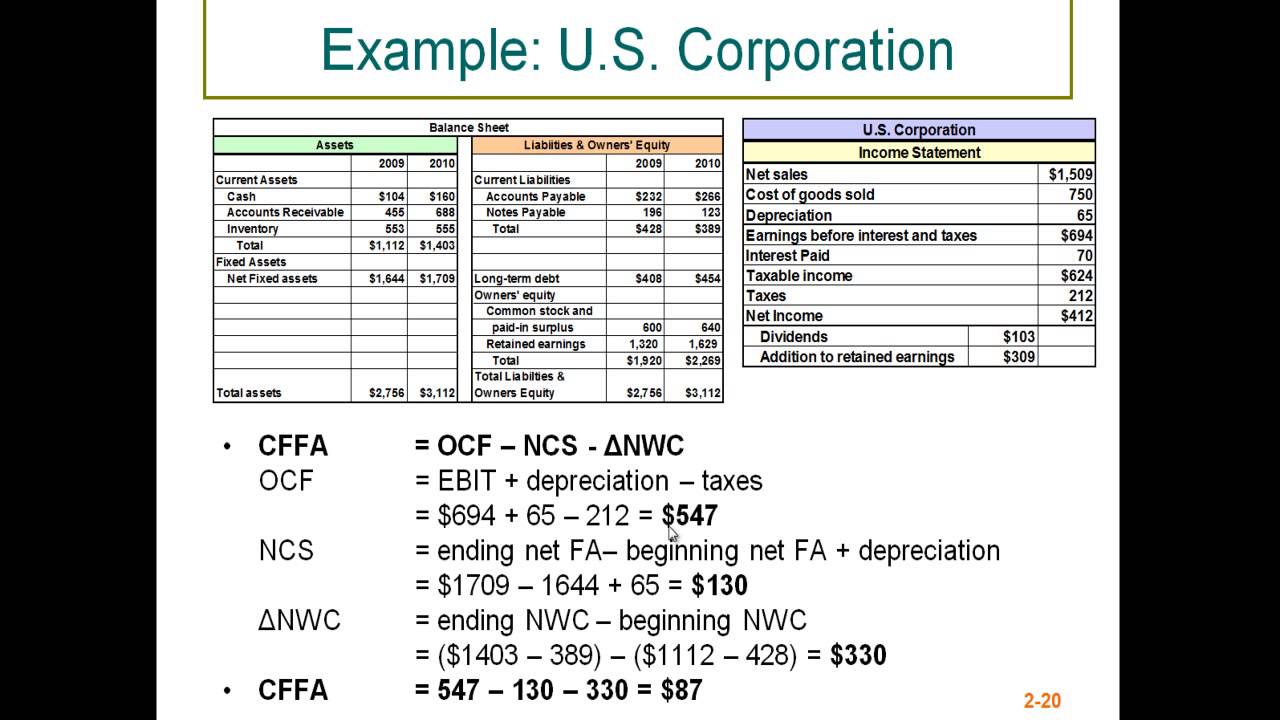

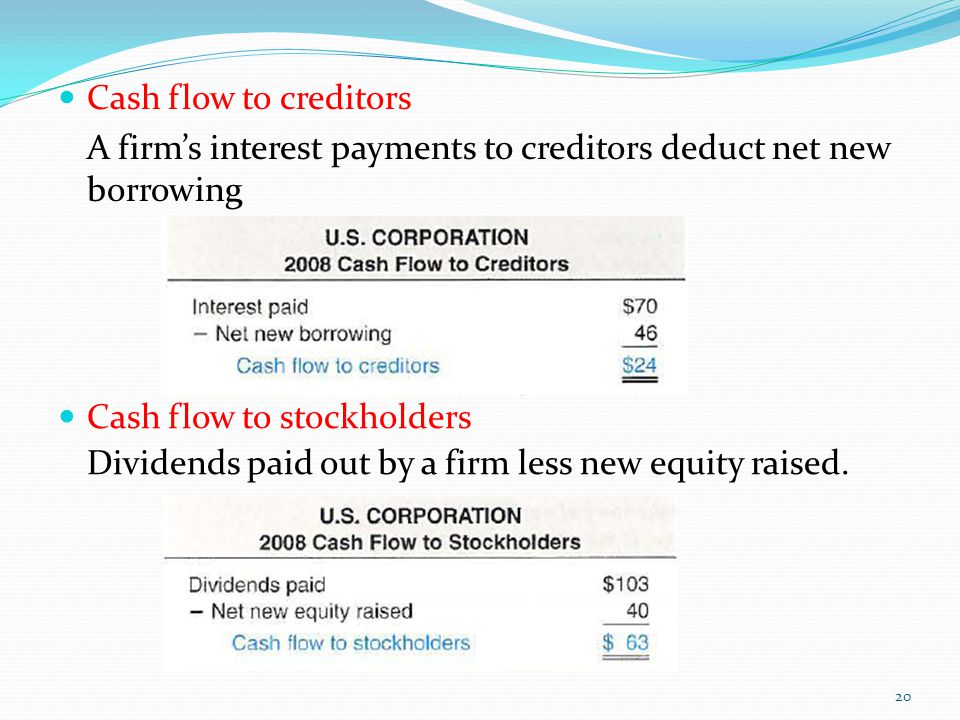

. It reflects the companys financing mix. Heres how this formula would work. Cash Flow to Creditors I - E B.

Cash flow is the measure of total amount of liquid cash that is moving in and out of the business. The available balances on your credit cards do not count as free cash flow what you spend using credit cards translates into negative cash. Use this simple finance cash flow to creditors calculator to calculate cash flow to creditors.

Important cash flow formulas to know about. Cash flow from financing activities CFF is the net flow of cash between the company and its owners creditors and investors. Net New Equity Allowed attempts.

This is a simple example of. The ending period of the long-term debt will. B Beginning Long Term Debt.

Ad Browse Relevant Sites Find Cash Flow Projection Template. CFC I E B Where CFC is the cash flow to creditors I is the total interest paid E is the ending long term debt B is the beginning long term. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Cash flow to creditors formula. Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure Operating Cash. The credit cards are the same for you there are no surprises there.

Predict Future Trends and Improve Your Cash Flow. There are two different methods that can be used to calculate cash flow. To calculate the debtors counterparty you calculate the amount of the payment that is owed to the creditor.

Here are some examples of how to calculate cash flow. Where I Interest Paid. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Equation for calculate cash flow to creditors is Cash Flow to Creditors I - E B. Ad Start Forecasting Your Cash Flow. How to Calculate Cash Flow.

Operating Cash Flow Net income Depreciation and amortization Stock-based compensation Other operating expenses and. Ad Optimize cash shore up your capital position extend your runway for business resilience. Ad Browse Relevant Sites Find Cash Flow Projection Template.

If you dont have enough credit then you might as well get a new credit card. How To Calculate Cash Flow To Creditors. E is the Ending of the long-term debt.

The detailed operating cash flow formula is. Calculating the cash flow statement is a lengthy process one which involves several variables. How do you calculate cash flow to creditors.

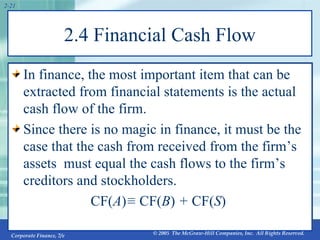

How do we calculate each of these components Cash flow to Creditors Cash flow to Stockholders. Easy to Use Online Tools. The first thing that comes to.

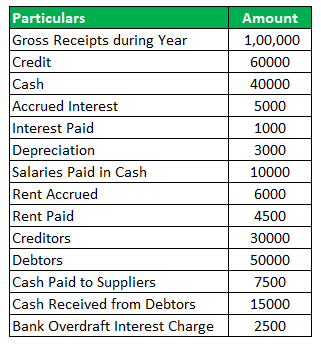

How do you calculate cash flow to creditors if you are not given long term debt. Example of calculating cash flow from assets. Along with the companys income you have to include the expenses credit payments receipts.

4 Formulas to Use Cash flow Cash from operating activities - Cash from investing activities Cash from financing activities Cash flow. Get driver-based cash flow forecasting and scenario analysis to fit your requirements. Interest Net New Borrowing.

E Ending Long Term Debt. I E B Over here I mean Interest Paid. You calculate cash flow by adjusting a companys net income through increasing or decreasing the differences in credit transactions expenses and revenue all of which are.

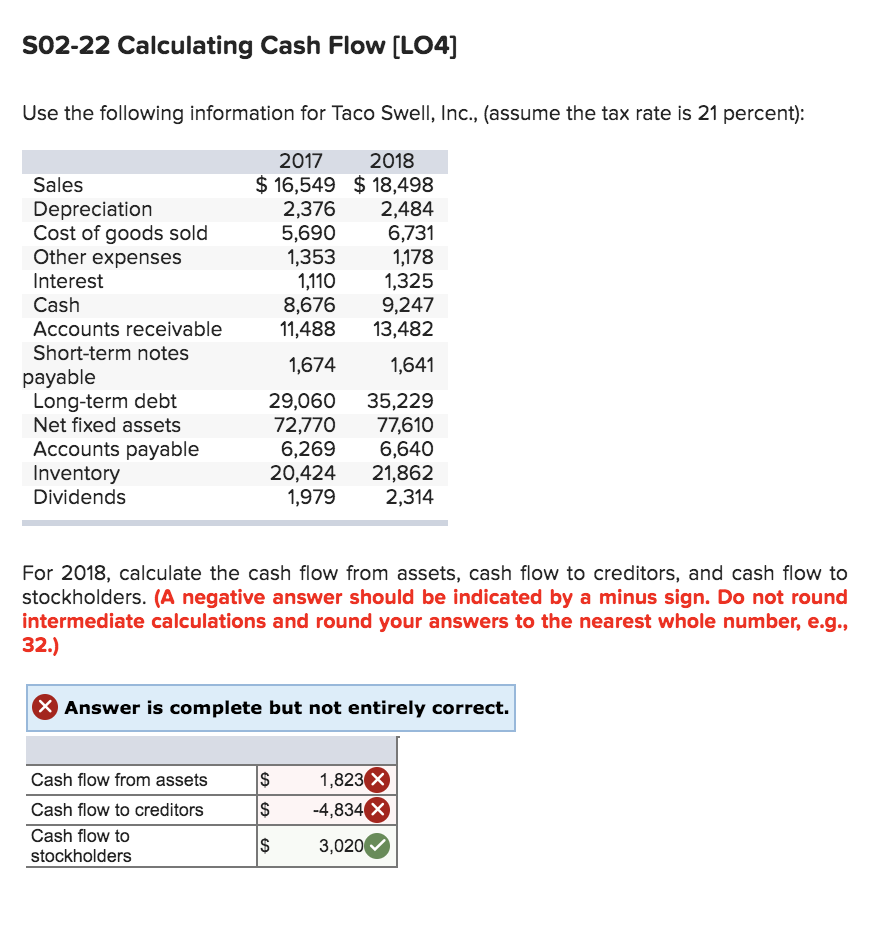

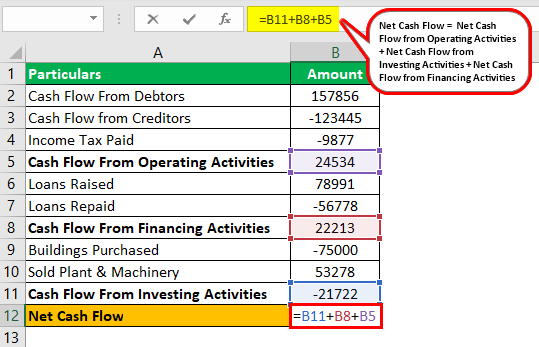

Solved S02 22 Calculating Cash Flow Lo4 Use The Following Chegg Com

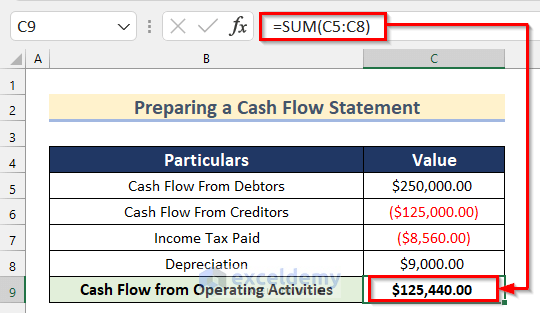

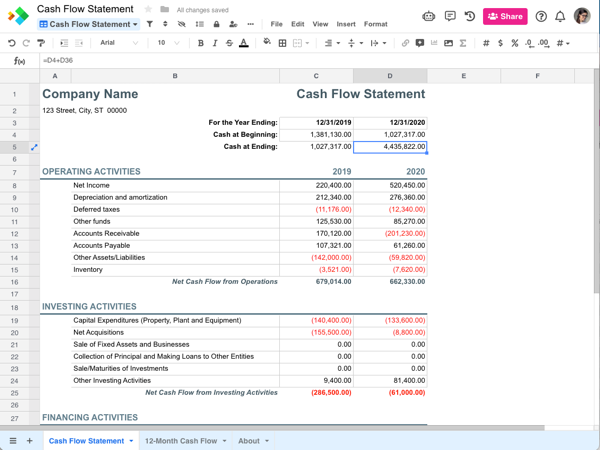

How To Calculate Net Cash Flow In Excel 3 Suitable Examples

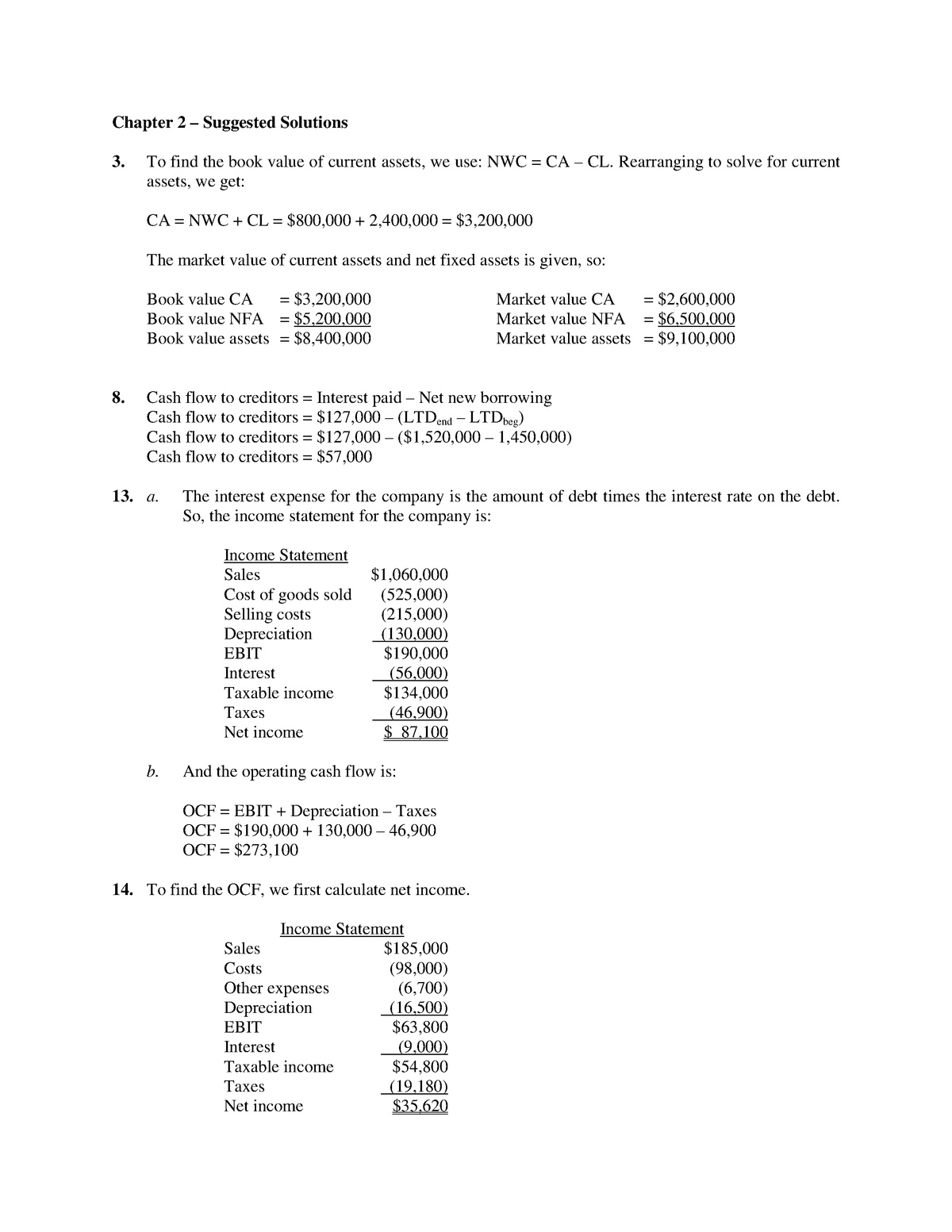

Tutorial 2 Chapter 2 Suggested Solutions 3 To Find The Book Value Of Current Assets We Use Studocu

Why Are Cash Flow Statements Important For Business

How To Calculate Cash Flow 15 Steps With Pictures Wikihow

Net Cash Flow Formula Step By Step Calculation With Examples

Types Of Cash Flow Operating Investing And Financing Explained Upwork

Net Cash Flow Formula Step By Step Calculation With Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Solved Use The Following Information For Taco Swell Inc Chegg Com

The Complete Guide To Cash Flow Management For Your Business

Solved Use The Following Information For Clarington Inc Assume The Tax Rate Is 34 For 2018 Calculate The Cash Flow From Assets Cash Flow To Course Hero

Cash Flow Statement Template Templates By Spreadsheet Com

Could A Company S Cash Flow To Stockholders Be Negative In A Given Year And How Might This Come

Cash Flow Definition How It Impacts Business And More Billtrust